The Initial Shock: What Happens Right After the Win

One minute, you’re checking your ticket with low expectations. The next, everything gets blurry. Jackpot winners often describe it as a wall of disbelief—some check the numbers five or six times. Then comes the adrenaline. You’re excited, sure, but also terrified. You’ve just crossed a threshold most people never do.

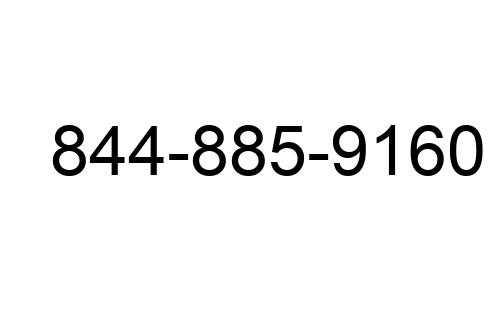

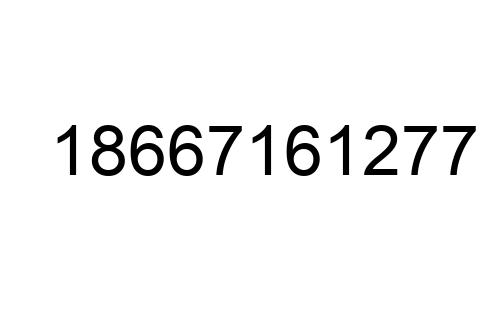

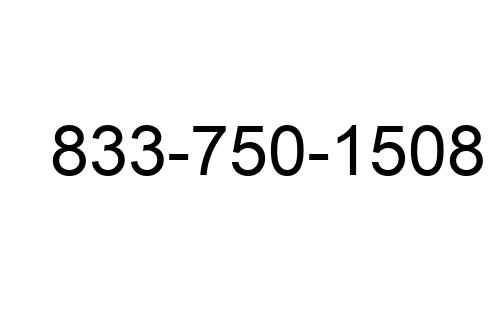

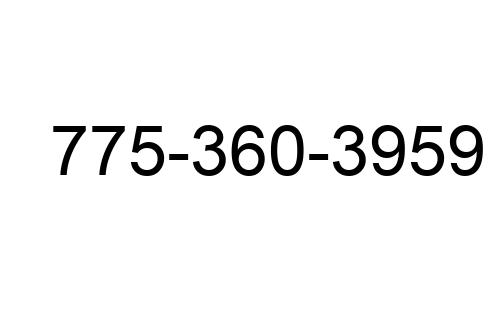

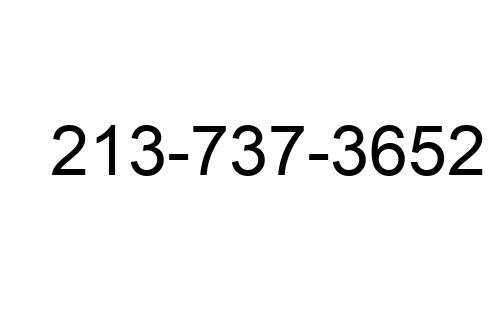

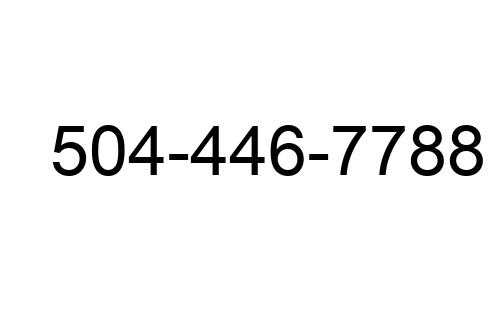

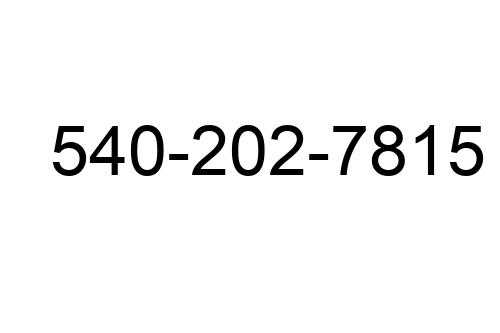

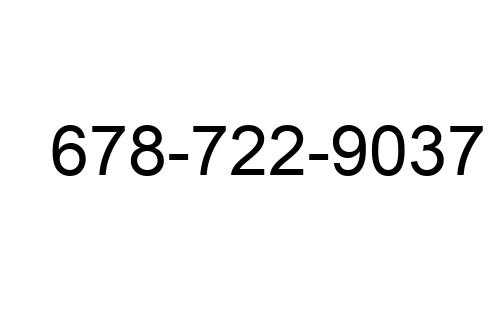

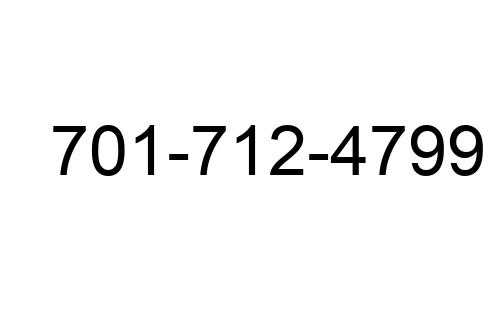

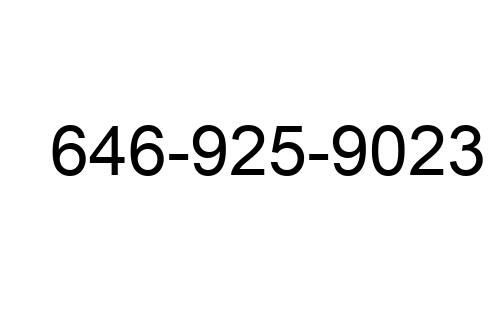

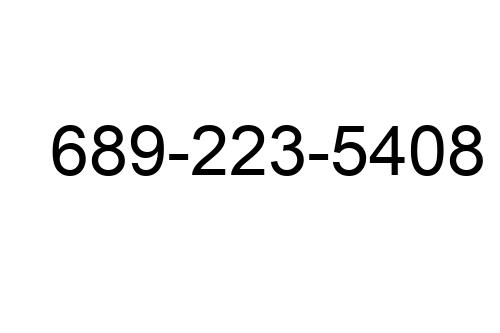

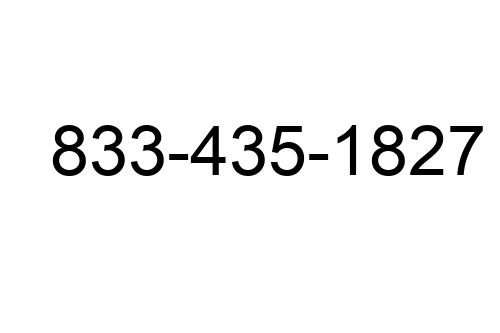

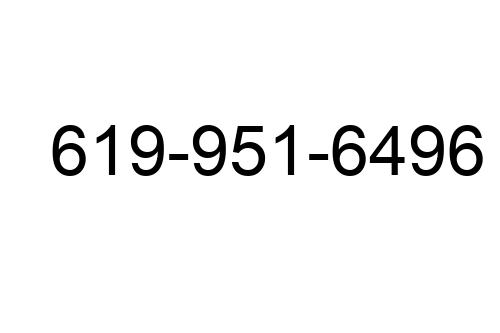

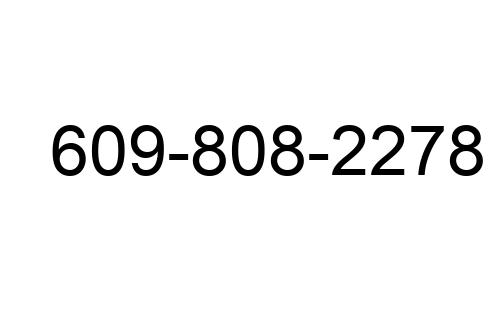

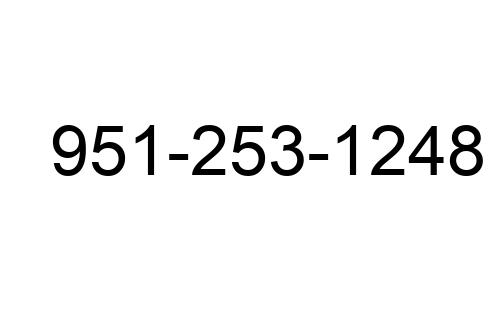

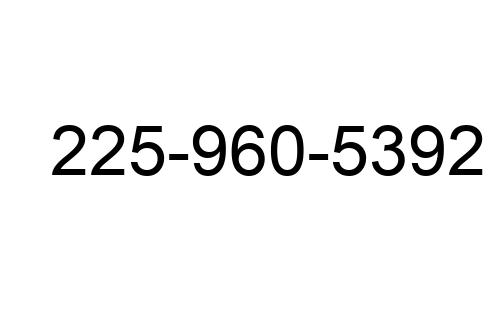

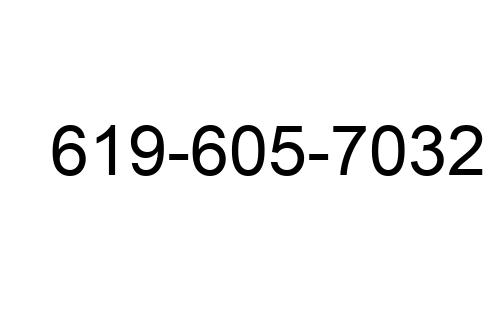

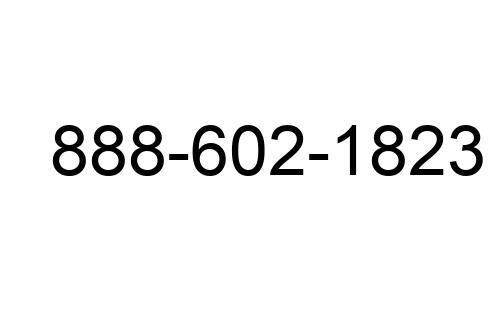

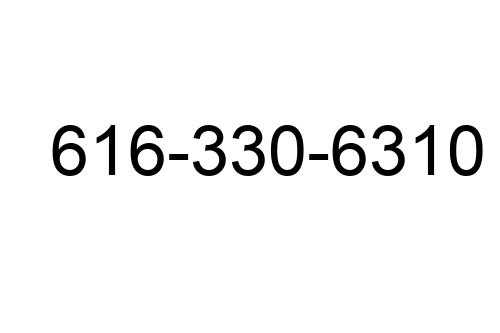

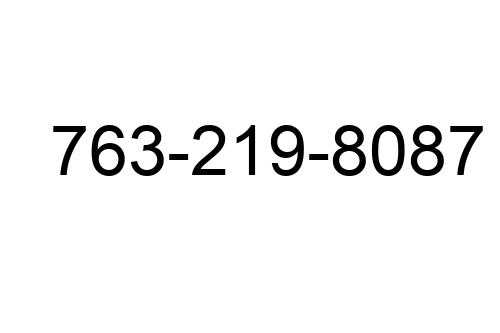

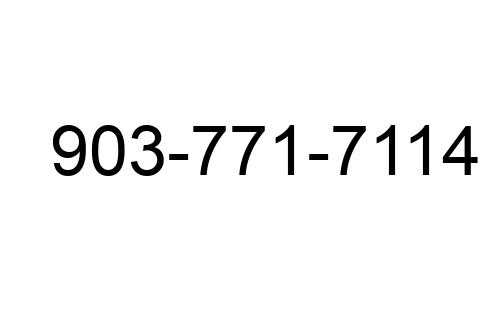

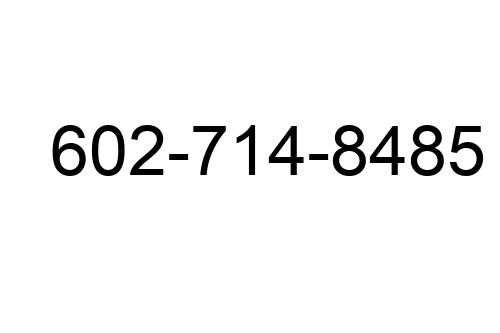

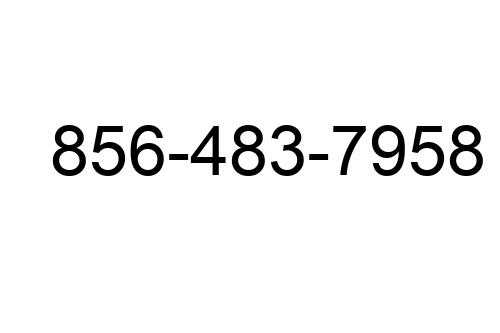

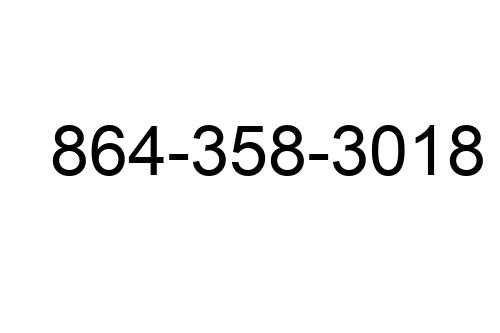

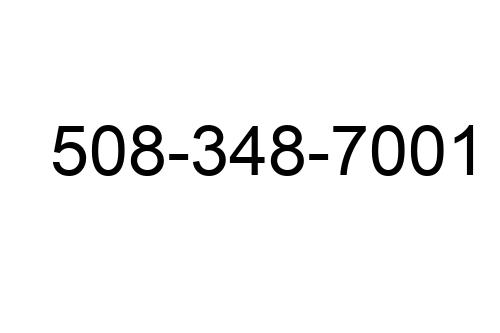

The first phone calls say a lot. Some people call family. Some go straight to a lawyer. Others don’t tell anyone, just sit in stunned silence and Google “lottery claim steps.” If there’s a smart order, it’s this: legal, financial, then family. You’ll want legal protection in place before word gets out.

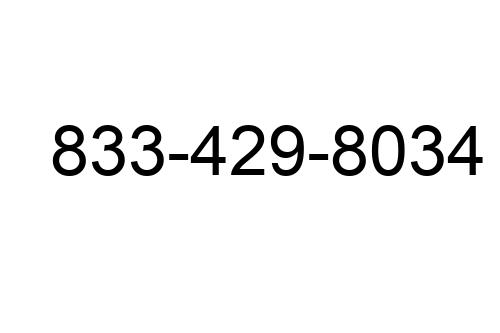

Then come the necessary first steps: sign the ticket, store it somewhere secure, and double-check the claim window. Get a lawyer on board to help with anonymity if possible. Contact a certified financial advisor who’s handled sudden wealth. Avoid flashy spending or announcements. For now, the goal is simple—pause, protect, and plan.

Spending Patterns: Where the Money Actually Goes

Winning big often triggers a predictable spending spree—mansions, luxury cars, first-class trips to anywhere but here. These big-ticket buys can feel like rewards after a lifetime of austerity, and in small doses, they make sense. But let’s be honest: a Lamborghini doesn’t generate income. It depreciates the minute it leaves the lot. The wise winners learn to separate show purchases from investments—sometimes with help, sometimes the hard way.

Next comes dealing with debt and spreading the wealth among family. Paying off mortgages and student loans is smart. But turning into everyone’s bank? That’s a short road to resentment and financial drain. Gifting with boundaries matters just as much as generosity.

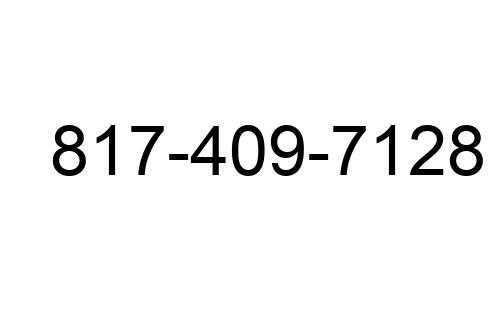

The sharpest move? Putting money to work. Investing in income-generating property, launching a business you actually understand, or building a modest stock portfolio that isn’t just hype and hearsay. These create long-term security, not just lifestyle boosts.

Then there’s giving back. Donations done right—whether to a local shelter or a nationwide cause—can be transformative. Not just for recipients, but for the winner too. Legacy doesn’t come from what you spend; it’s built through intention and impact.

In the end, it’s not about denying the joys of indulgence. It’s about not letting them define your newfound fortune.

The Smart Moves (and the Costly Mistakes)

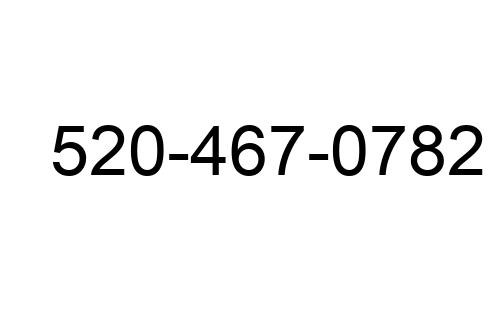

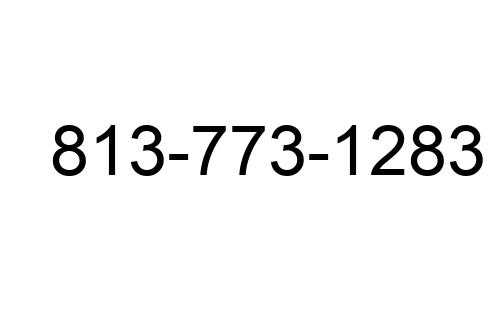

Sudden wealth creates opportunity—but also serious financial risk. For jackpot winners, what happens after the initial celebration sets the tone for everything to come. Some winners go on to build stable, fulfilling lives, while others face a rapid fall into debt, regret, or even bankruptcy. The difference? Smart financial strategy.

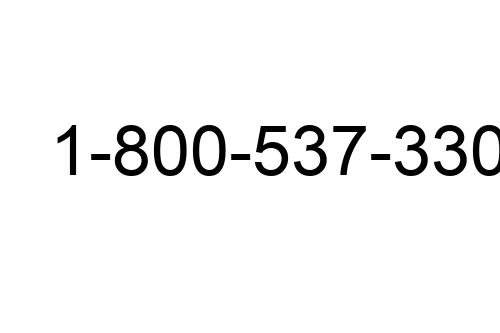

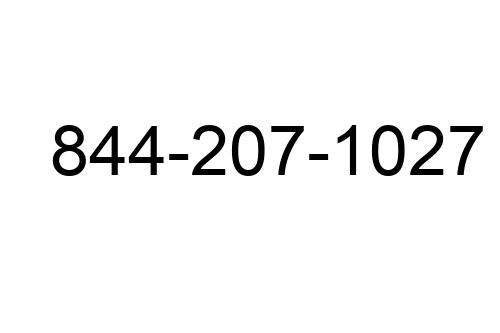

Financial Planning 101 After the Windfall

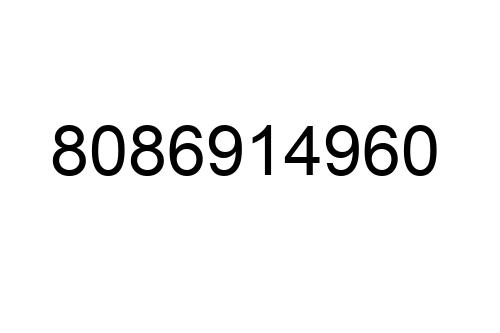

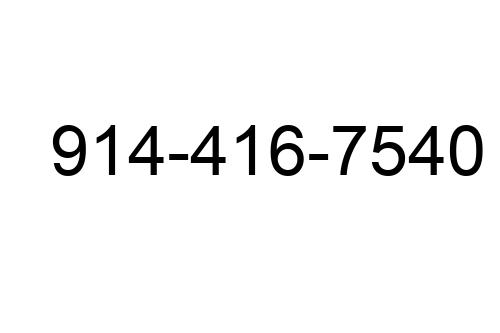

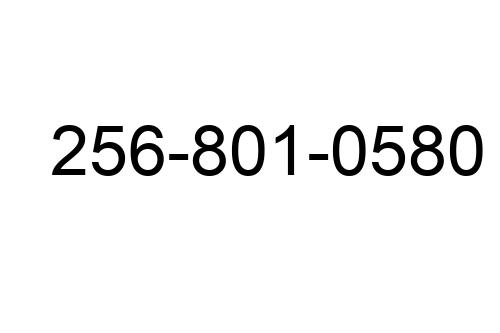

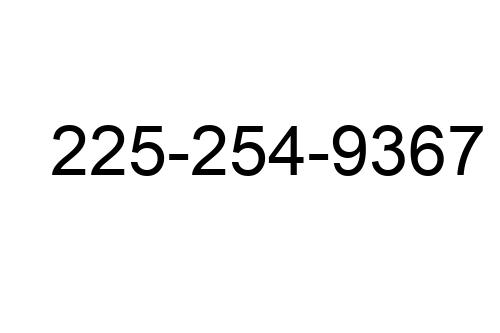

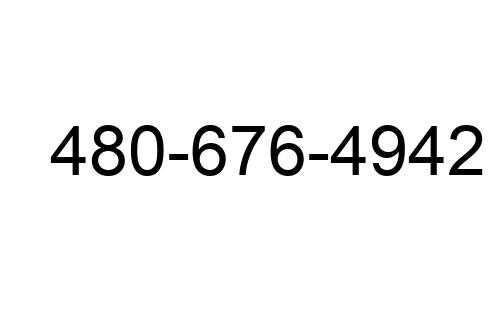

Without a solid plan, even millions can disappear fast. The first crucial step for winners is to pause, breathe, and build a framework before spending a dime.

Key first moves include:

- Establishing a temporary hold on extravagance

- Opening secure bank accounts for holding funds

- Creating a financial goal map for the next 5–10 years

This isn’t the time for guesswork—it’s the time for preparation.

Why Some Winners Stay Wealthy (and Others Don’t)

Remaining rich isn’t about how much you win—it’s how you manage that win. Winners who thrive long-term typically:

- Adopt a long-term budget and stick to it

- Treat their winnings like capital, not cash

- Invest thoughtfully rather than impulsively

On the flip side, many who lose it all do so due to unrestrained spending, poor investments, and underestimating tax obligations.

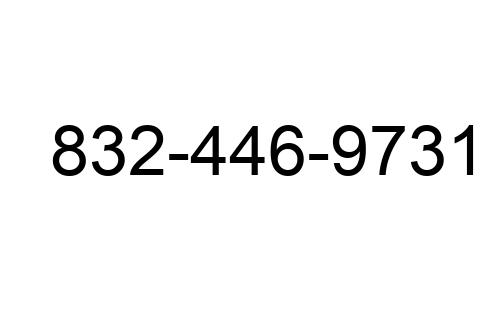

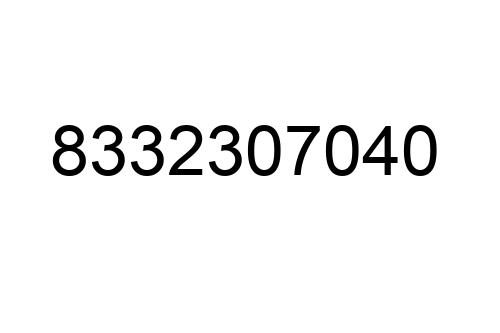

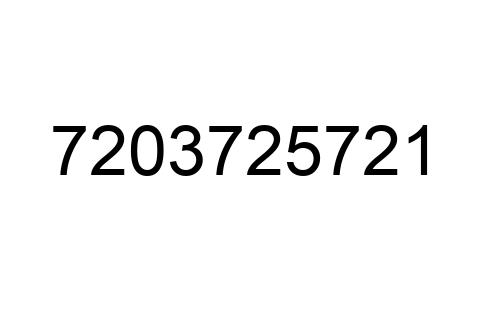

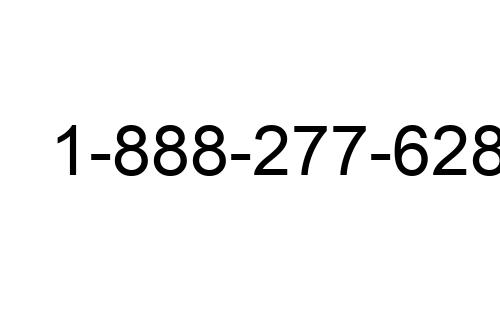

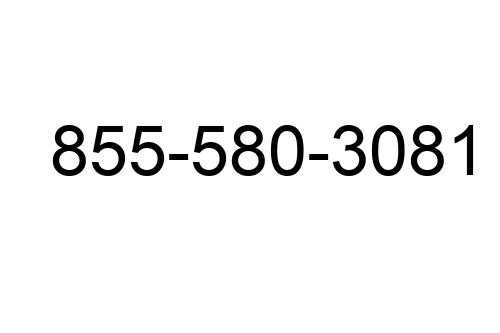

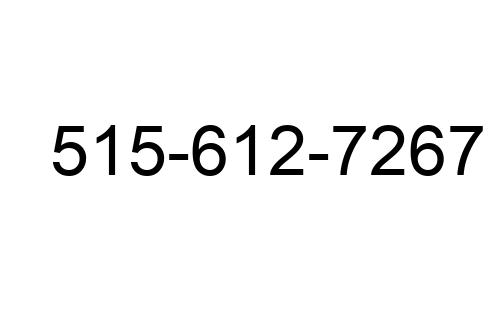

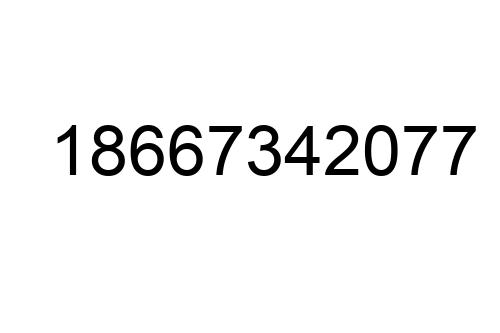

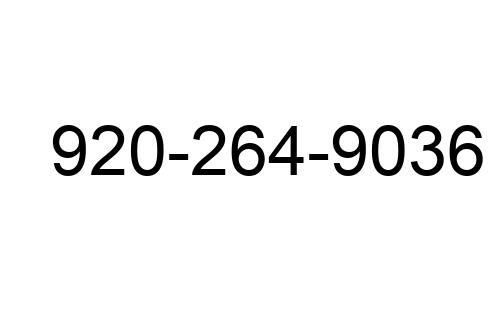

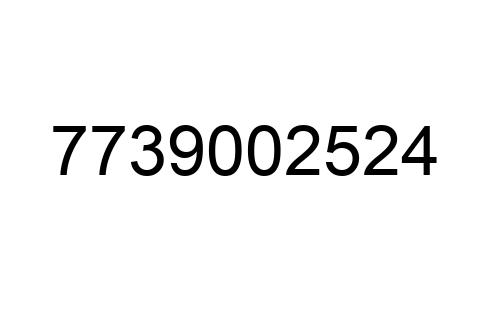

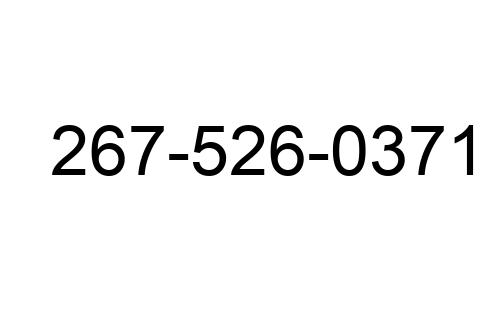

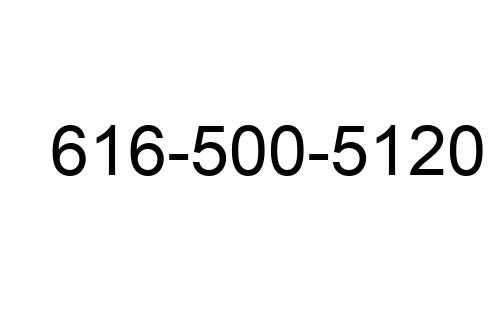

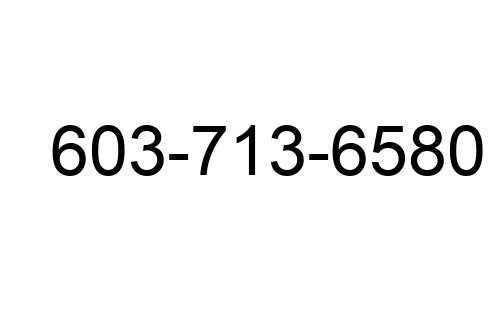

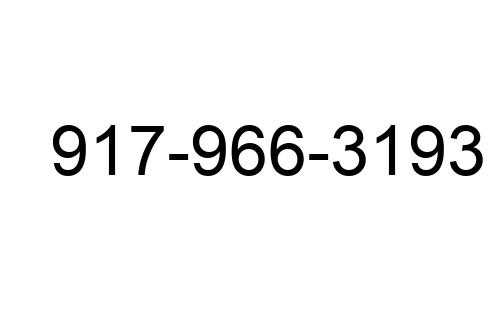

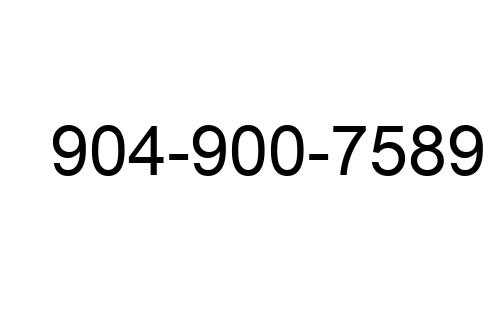

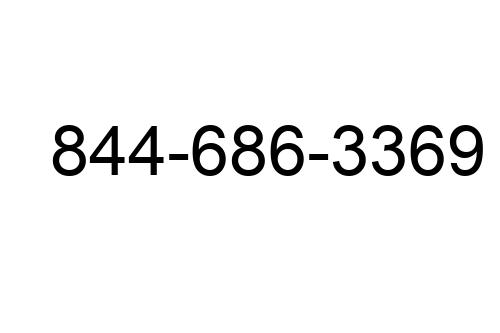

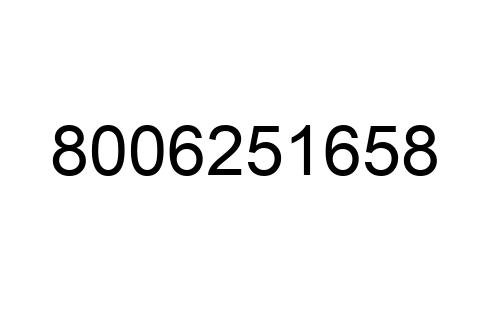

Your Core Financial Team: Who You’ll Need

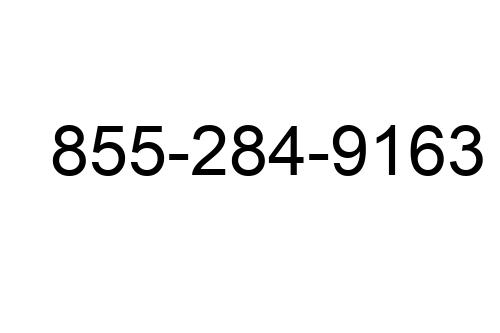

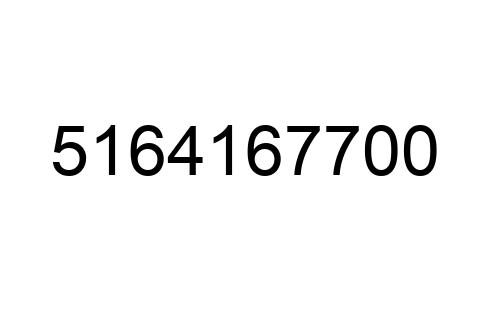

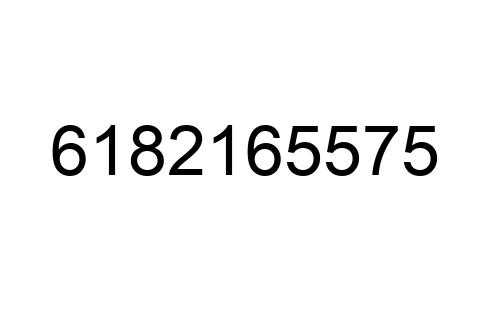

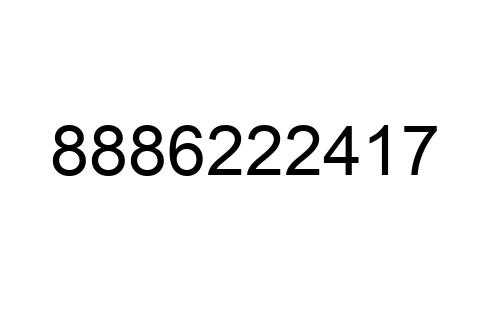

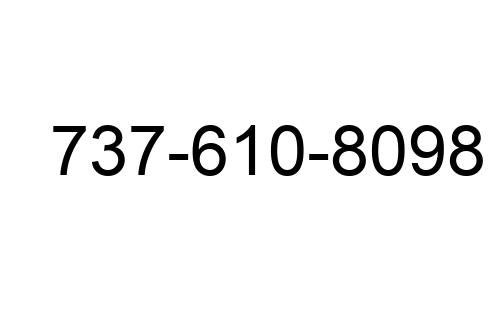

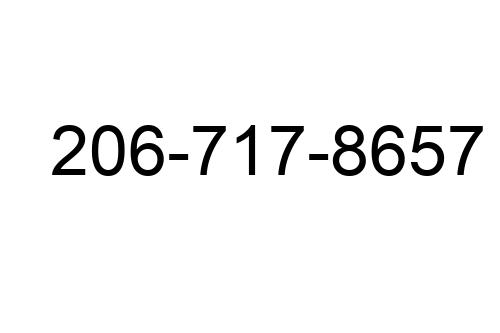

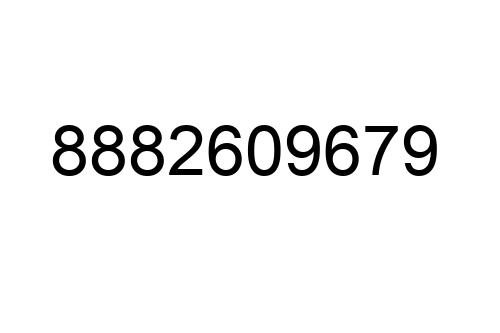

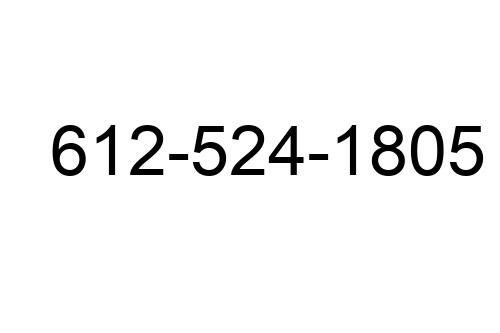

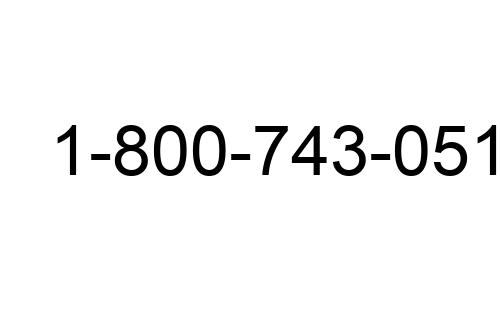

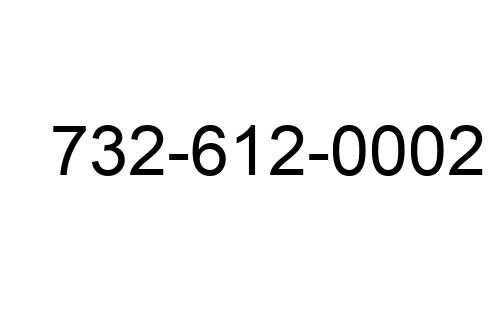

Managing millions is not a solo act. Smart winners build a trustworthy circle of advisors:

- Certified Financial Planner (CFP): Helps build a diversified, tax-efficient strategy

- Tax Professional: Navigates national and local tax obligations

- Estate Attorney: Helps secure your wealth for future generations

The most successful winners build transparent relationships with experts who educate as well as guide.

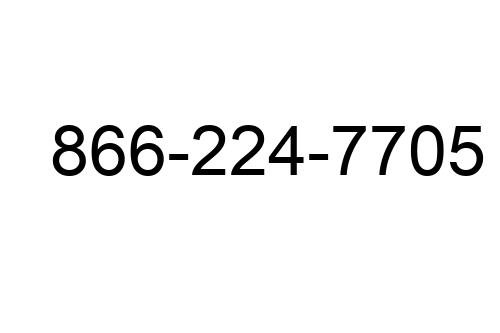

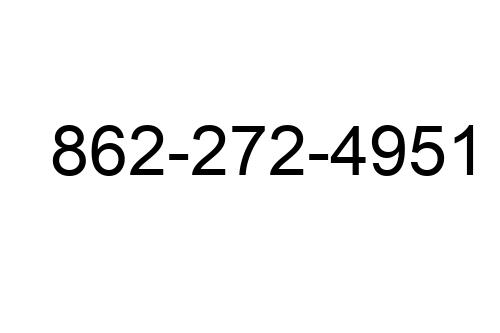

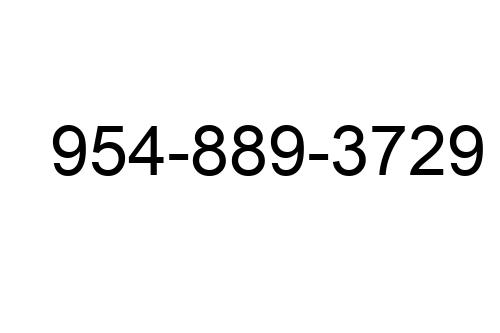

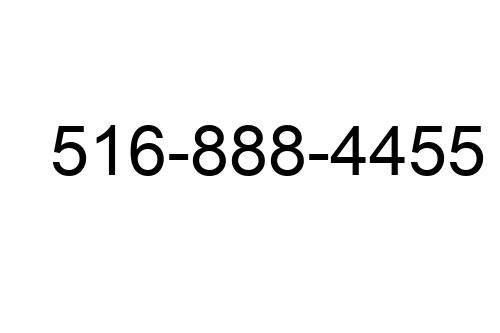

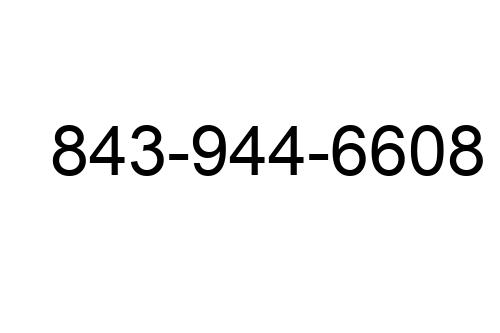

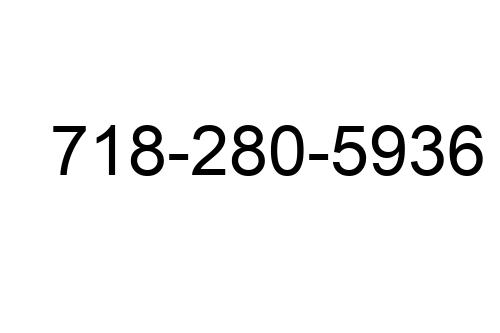

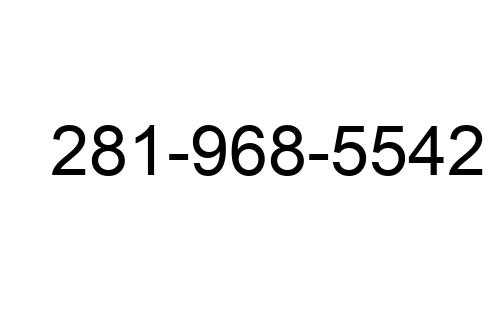

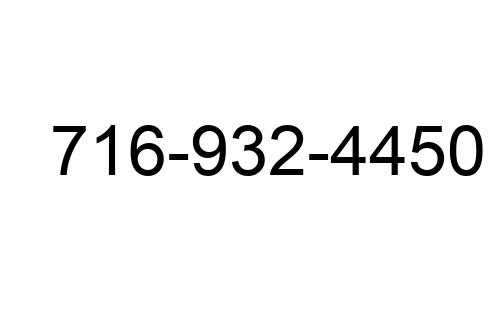

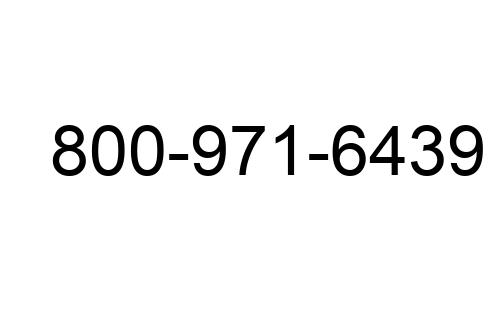

The Hidden Costs You Didn’t Plan For

Millions come with invisible price tags. Newfound wealth often makes you a magnet for requests, and that expands your financial footprint in unexpected ways:

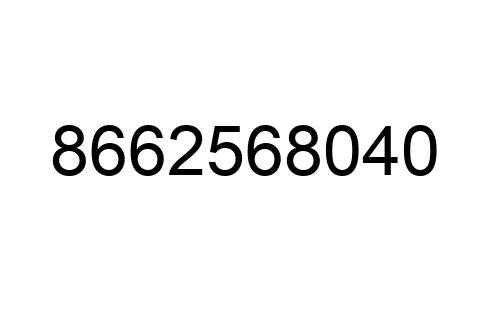

- Heavy taxes: Depending on location, taxes can strip away a third (or more) of your winnings

- Lifestyle inflation: Upgrades become the new normal; recurring costs increase fast

- Unexpected generosity: Family, friends, and even acquaintances may ask for help—and saying no isn’t easy

Smart planning accounts for all of these and puts guardrails in place before the pressure builds.

Bottom line: Staying rich takes more skill than getting rich. Strategy, support, and self-control are the pillars that keep winners truly winning.

Long-Term Life Changes

Winning a jackpot doesn’t just change your finances—it rewires your reality. For many winners, there’s a disorienting shift in personal identity. You’re the same person, but now the world sees you differently. Some lean into it, upgrading their wardrobe, their zip code, and their lifestyle. Others stay low-key, trying to hang onto a sense of normalcy that slips away anyway.

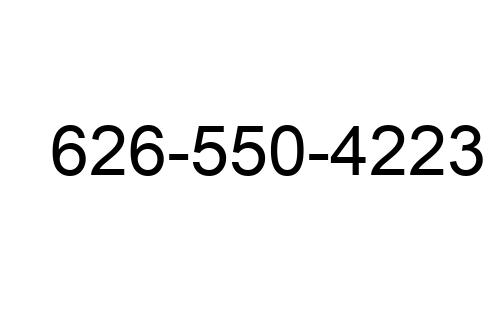

Career-wise, it splits two ways. Some walk away from work and never look back. Others finally get the freedom to build the thing they couldn’t when time and bills were tight—start a nonprofit, open a bar, make art without worrying about rent. The win becomes a launchpad, not the exit.

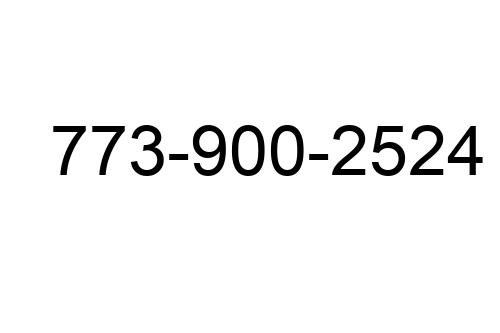

Socially, it gets messy. Old friends may drift or get weird. Trust becomes a filter, not just a virtue. You spend more time second-guessing motives and less time being spontaneous. It can feel like everyone wants something—or nothing, out of envy or discomfort.

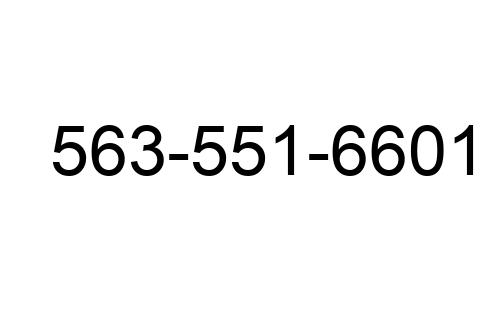

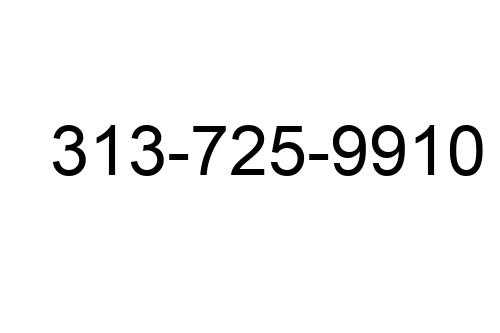

Then there’s the mental load. Most people assume winning kills anxiety. In reality, it replaces old stress with new kinds: fear of losing it, fear of wasting it, fear of not living up to it. Pressure mounts fast. Isolation creeps in. If you’re not intentional about setting boundaries and protecting headspace, you end up with more money—and more noise.

Still, for those who face the shift head-on? The prize is bigger than the payout: agency, time, and the chance to rebuild on your terms.

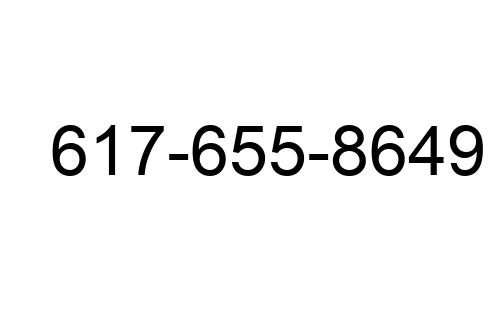

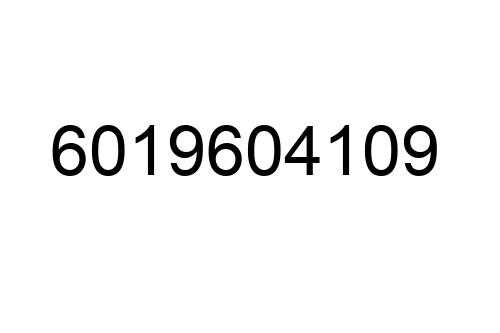

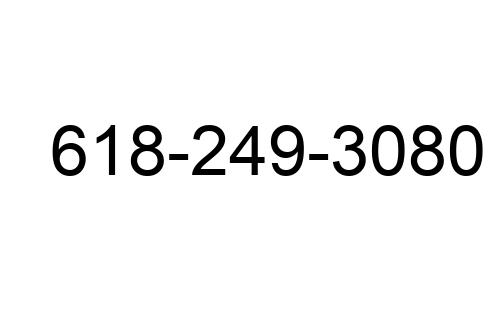

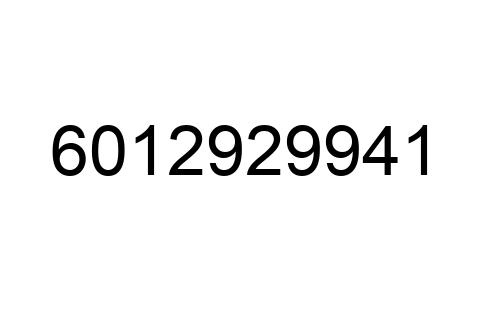

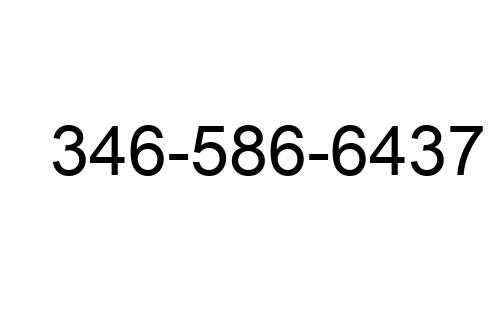

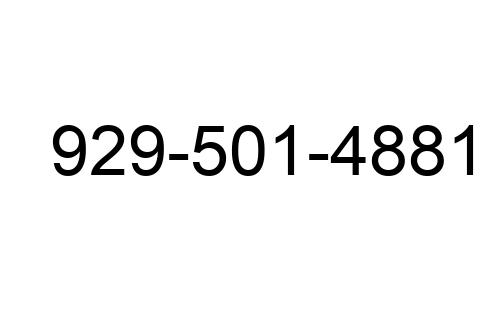

Real Stories from Real Winners

Once the confetti settles, jackpot winners tend to go one of two ways: quiet success or public flash. The quiet ones keep their circle tight, move smart with their money, and often fade into regular life—just with fewer bills and better vacations. The flashy ones, on the other hand, go big. They launch into luxury, spend fast, and show it off. Both paths come with baggage.

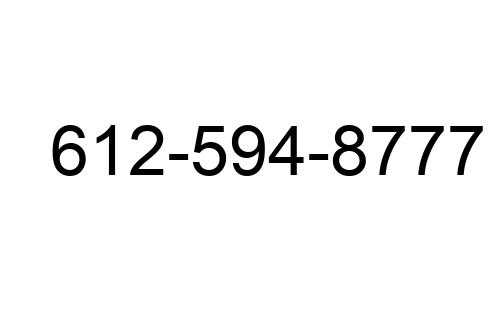

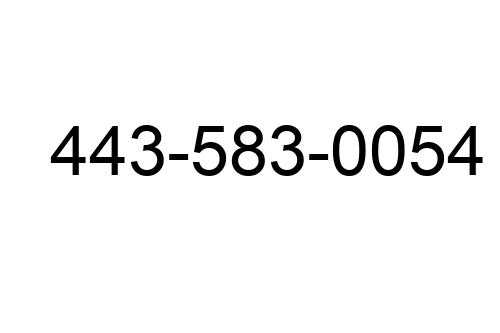

Across the board, here’s what many say they wish they’d known: how fast money can complicate simple things. From strained friendships to financial blind spots, winners realize late that wealth doesn’t come with a manual. More than a few regret not taking time to pause before making big moves.

The most surprising change? It isn’t the cars or the homes—it’s how people treat you. Some get distant. Others show up with open hands and old stories. Trust becomes currency. And while winning big means you never have to worry about bills, it also means you start questioning motives more than you’d like.

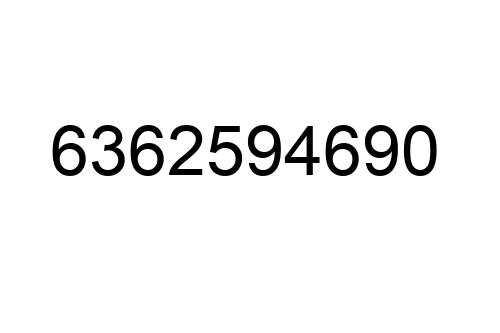

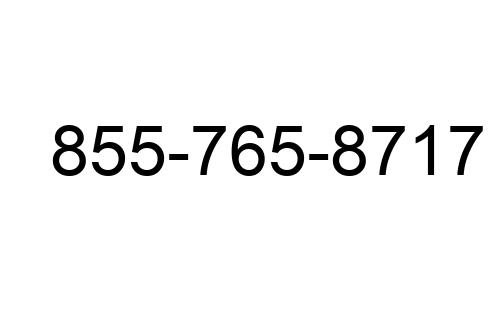

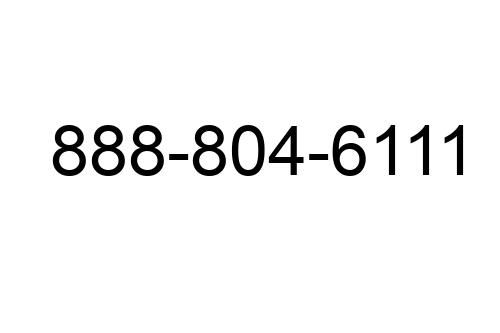

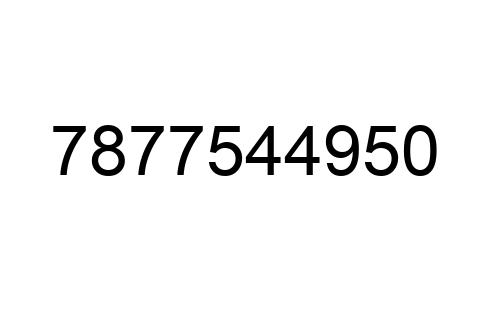

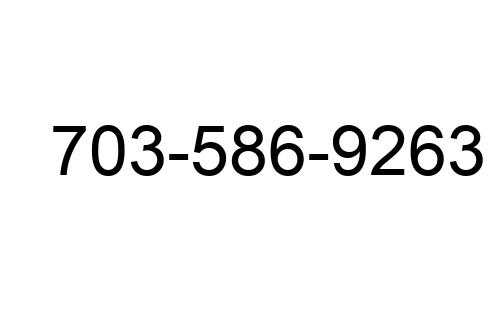

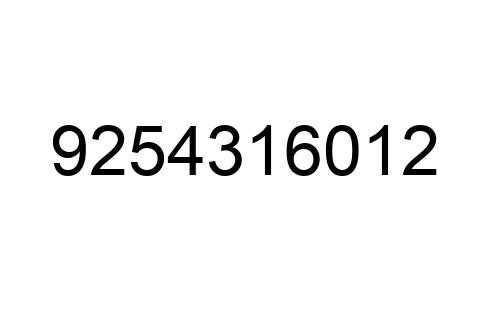

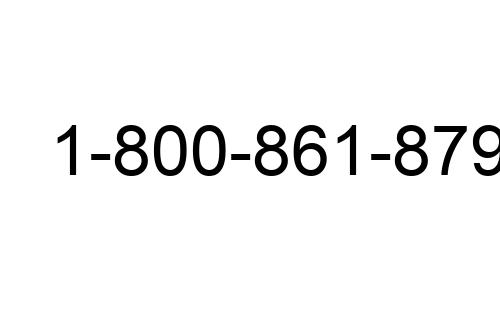

For the full story from someone who’s lived it, check out this honest Interview with a Jackpot Winner – Their Story and Advice.

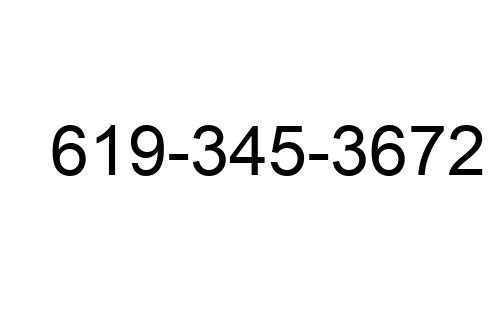

Key Takeaways: Lessons from the Lucky Few

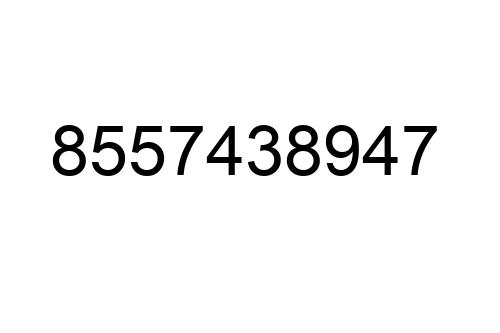

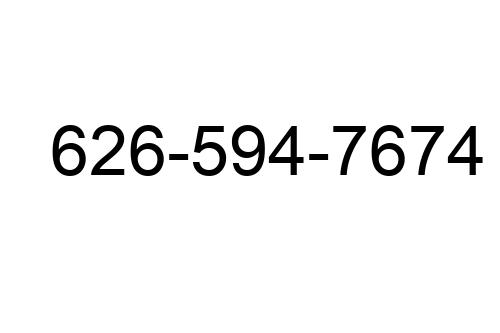

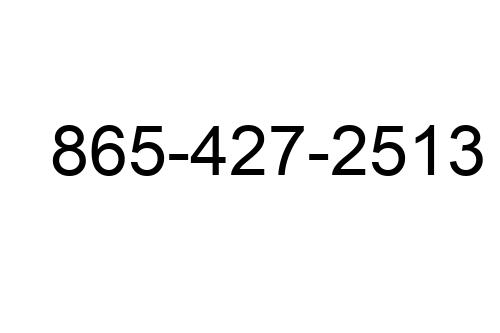

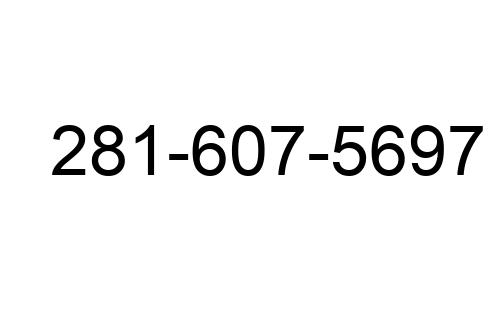

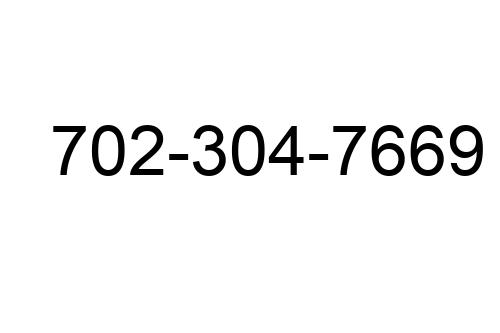

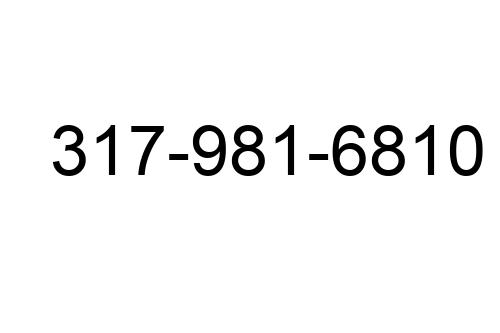

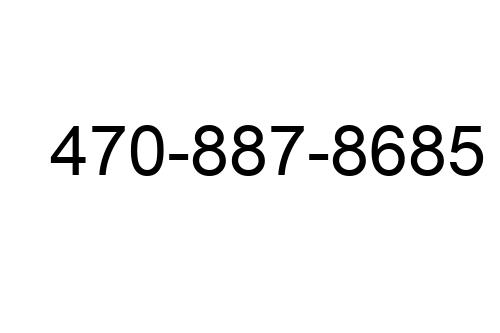

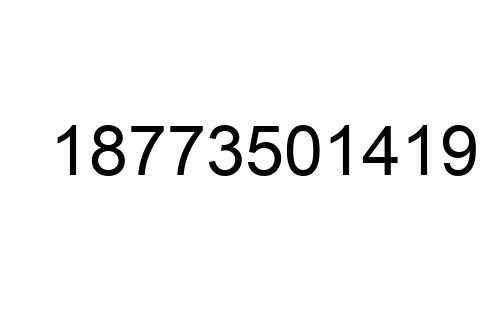

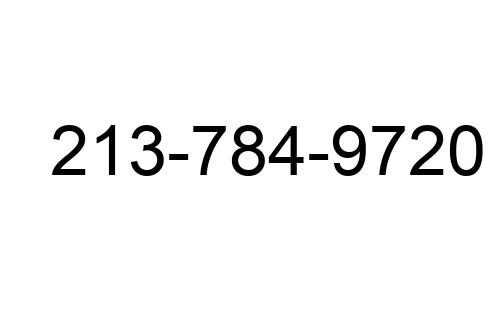

Everyone talks about the money. Few talk about what it takes to handle it. A sudden windfall can fix problems, sure—but it also creates new ones you didn’t see coming. That’s why the real story isn’t about what jackpot winners buy. It’s about how they shift from being spenders to stewards.

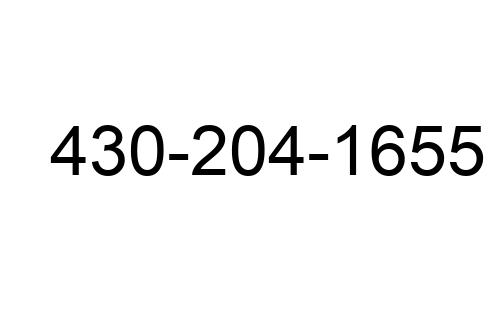

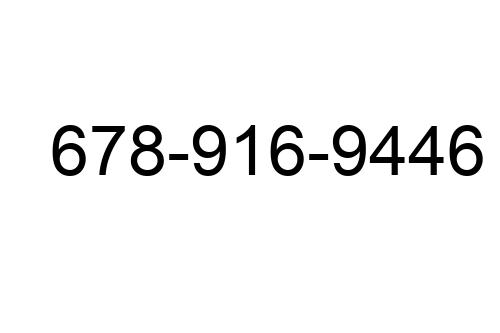

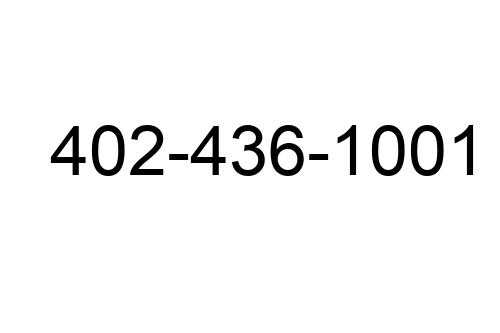

The winners who last—the ones who aren’t broke five years later—learn to treat their wealth like a job. Not a party, not a miracle. They build structure: budgets, trusted advisors, long-term goals. They say no more than they say yes. And not because they can’t afford it—but because they know it’s not about not spending. It’s about spending with clarity.

You can still buy your dream car. You can fund your cousin’s business. But you plan it. You take your time. You pause before jumping. The most successful winners move quickly to set up a solid foundation, then slow down to live their lives on their own terms.

So here’s the bottom line: Plan fast. Live slow. Stay grounded. The money’s not the story—you are.